CELEBRITY

It really IS Swiftenomics! Bank of England could delay cutting interest rate to September after Taylor Swift’s Eras Tour boost to UK economy, experts claim

The Bank of England could delay cutting interest rates until September as the UK economy is boosted by Taylor Swift’s Eras Tour, analysts have claimed.

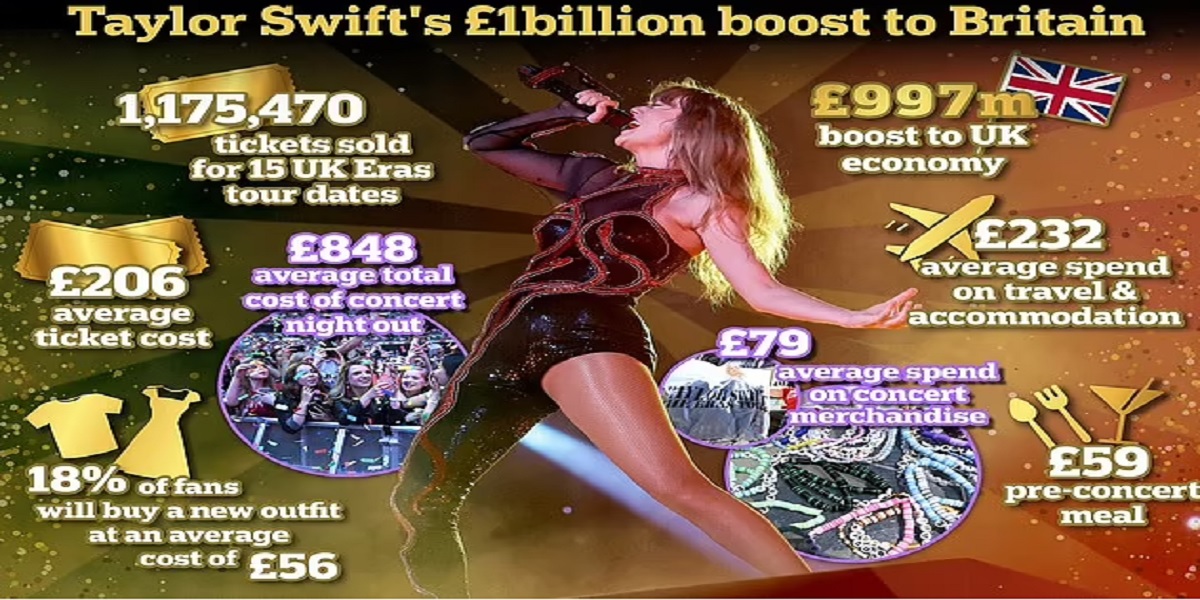

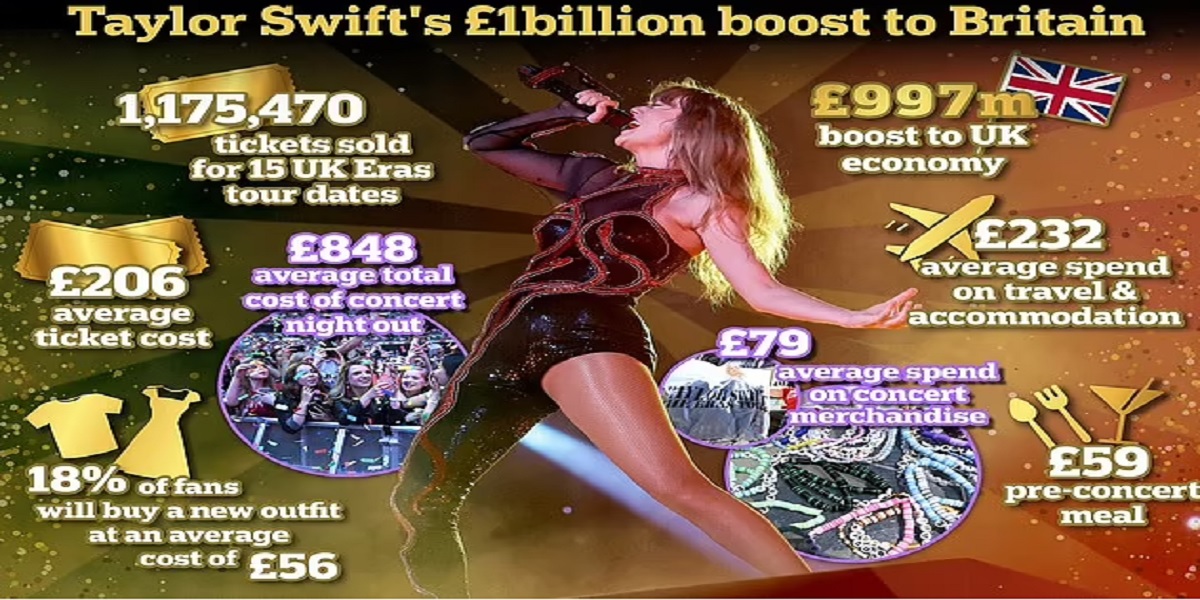

The pop star has already played sell-out shows in Edinburgh, Liverpool and Cardiff as well as three in London – and will head back to Wembley this August for five more.

Swift’s fans, known as ‘Swifties’, are expected to boost the London economy alone by £300million as the capital hosts more Eras Tour shows than any other city in the world, with nearly 640,000 people expected to attend across the eight dates.

The Bank’s Monetary Policy Committee (MPC) voted last Thursday to keep interest rates unchanged at a 16-year high of 5.25 per cent for the seventh time in a row.

Many analysts expect the next cut to be in August, but experts at London investment bank TD Securities believe the economic boost Swift’s concerts are giving Britain is so significant that it could be enough to defer the reduction until September.

The bank’s macro strategist Lucas Krishan and its head of global macro strategy James Rossiter made the claim in a note on June 14, reported CNBC.

They said: ‘We still anticipate a BoE cut in August, but the inflation data for that month might keep the MPC on hold in September.’

The analysts pointed out that a potential clash with one of Swift’s Wembley concerts between August 15 and 20 and a key inflation index day could skew the data and influence the MPC’s decision.

Mr Krishan and Mr Rossiter added that a ‘surge in hotel prices then could be material’, temporarily adding as much as 30 basis points to services inflation and 15 basis points on headline inflation.

They also said that while her Cardiff date coincided with this month’s inflation index day, the impact would have been lesser given the smaller size of the city to London and just one date there.